This is a collection of short Accounting Essentials articles that we believe every business owner should read and consider.

Articles written by other authors are linked and attributed with appreciation.

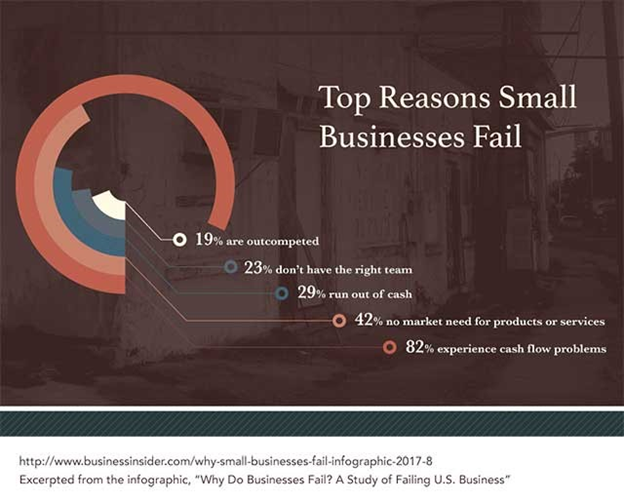

The #1 Reason Small Businesses Fail - And How to Avoid It

Brian Sutter - June 1, 2019

Cash flow.

Mention those two little words to almost any small business owner, and you’ll see them flinch.

Very few business terms get as cool a response. And sadly, those two little words (both of them four-letter words, interestingly enough), are the #1 reason small businesses fail. They take out more small businesses than any other factor.

82% of small businesses fail due to cash flow problems.

Brian Sutter - June 1, 2019

Cash flow.

Mention those two little words to almost any small business owner, and you’ll see them flinch.

Very few business terms get as cool a response. And sadly, those two little words (both of them four-letter words, interestingly enough), are the #1 reason small businesses fail. They take out more small businesses than any other factor.

82% of small businesses fail due to cash flow problems.

And while most small business owners agree cash flow is the #1 risk for small businesses, cash flow is also a blanket term – a symptom, if you will – of several underlying causes.

When you look at those underlying causes, you can better see how to solve the cash flow symptom.

1. Develop a minimum viable budget.

Or, in other words, stay cheap.

Here’s what I mean: As your business launches and grows, there will be a push and pull between funding and supporting that growth, and being conservative with your spending. When in doubt, stay conservative. The “lean and mean” startup headset – and the concept of a minimum viable budget - is your friend.

You need a lean operating budget that can get through hard times. And you must expect and prepare for those hard times. Do not think that your business will be the sunny exception that never has trouble.

That’s the trick with a lot of budgeting – to continue to be careful with your money even when times are good. Actually, you have to save money and stay frugal when times are good. Because if you can’t save then, in the good times, it’s unlikely you’ll do it when business gets tough.

2. Protect your credit.

Have you ever seen a business start to slowly fall apart?

Often, the first sign of trouble is that they start delaying payment on their bills. Or they’ll change their payment terms from 30-day net to 90-day net. The move doesn’t fool anyone. Even interns know what it means when a company delays paying its bills.

In the next phase after delaying payments, a company will start playing the game of “who can we not pay for as long as possible”. It’s risky because eventually the business makes a mistake and their credit gets dinged. Or one vendor gets fed up enough to finally call a collection agency, or to stop service.

Once that’s happened, it’s often too late.

As the saying goes, “you can only get a loan when it looks like you don’t need one.” Once you’ve shown signs of being financially strained, your loan options dwindle dramatically. And even if you can get a loan, the terms will be far less attractive.

3. Manage your inventory like it was your biggest, most expensive business asset.

Because that’s exactly what it is.

Poor inventory causes a slew of expensive problems that can directly impact cash flow. They include:

• Ordering new items you don’t actually need, simply because you couldn’t find them.

• Expired items that should have been sold (even at a discount) before they became worthless.

• Unfulfilled ordered based on inventory demands you could have predicted.

• Extra costs accrued by having to fill those backorders.

• Disappointed customers who have to wait for backorders to be filled.

• Wasted employee hours spent looking for lost inventory, placing rush orders, managing back orders.

• The steep cost of paying for more inventory space than you would actually need – if your inventory was properly managed.

This list goes on, but I think you get the idea. This is an expensive problem that’s surprisingly widespread. 43% of small businesses do not track their inventory or use a manual process. And 55% of small businesses do not track their assets or use a manual process.

4. Have cash reserves.

If your business slowed down for three months, could you manage the downturn financially? What about six months? A year? More than a year?

It’s not a fun exercise, but you might want to talk with your accountant about how well-positioned you are for an extended period of a soft economy. You never know – the news might be better than you think. Maybe you are well-positioned to get through a bad spell.

But if you’re not, you’re still lucky. You’ve got time to get ready. It might be worthwhile to slow down your company’s growth if only by a little, to make sure you’ve got cash reserves to manage everything if business conditions changed.

Again – this isn’t a fun conversation to have, and it could mean you have to do a little bit of belt-tightening. But it’s a far easier conversation than have to tell employees they’re out of a job.

5. Get yourself a great accountant (or CPA).

Problems with cash flow rarely come out of nowhere. They usually accumulate over time, in one form or another, while the business owner is busy with any number of other projects and responsibilities.

That’s why having a great accountant or a CPA can be so helpful. If you’ve got a smart, proactive financial professional who’s really looking at your company’s finances with rigor and insight, you’ve got a fantastic insurance policy against cash flow problems (and many other financial woes).

Unfortunately, that same quality of a great accountant – being proactive – is also the #1 quality business owners say their accountant lacks. Almost half of all small business owners, regardless of the size of their business, say their accountant is “more reactive than proactive.”

On the positive side, though, about half of small business owners don’t have this problem. They do have a proactive financial partner. Be like those business owners. It might just save your business.

Conclusion

Cash flow problems are almost like death and taxes. You’re never going to escape them. But it is possible to manage cash flow. And you can definitely tame it to a point where it doesn’t threaten your business.

Who knows… maybe you’ll even be among the happy group of small business owners who don’t frown or shrug when people mention these two little four-letter words.

About the Author(s)

Brian Sutter is the Director of Marketing for Wasp Barcode Technologies, a software company that provides solutions to small businesses that increase profit and efficiency. He has contributed content for Forbes, Entrepreneur, Marketing Profs, the Washington Post, Fast Company, Allbusiness.com, Business.com and Huffington Post.

Brian Sutter, Director of Marketing, Wasp Barcode Technologies

The Importance of Having an Accountant

From Inc. magazine October 2018 by Marla Tabaka @MarlaTabaka

Behind every successful entrepreneur, there is a team of people who offer support in one form or another. Aside from partners and employees, there are key relationships that require your time and attention, no matter how busy and overwhelmed you are. Those are a small business attorney, an industry mentor, at least one leadership mentor (virtual mentors count), a great coach, and a financial advisor/accountant.

It's the financial piece I'm focusing on today. Many small business owners manage their finances alone, which is rarely a good idea. In my experience, some small business owners may be good with numbers but aren't always skilled in the area of analyzing them and spending their money wisely. I don't necessarily mean they squander money, but that they don't invest enough of it into the areas that will help them succeed, like marketing, technology, and customer service.

This is important to note because research shows that 65 percent of the entrepreneurs who cite a business issue (versus a personal issue) as a reason for failure blame financial mismanagement for their collapse. This study, performed by Xero, a provider of cloud-based accounting software, was based on a survey of over 2,000 current and former business owners in the U.S. and U.K. All of these small businesses were staffed by 20 or fewer employees, some had reached the five-year mark; the others had shut down.

Successful entrepreneurs don't make the mistake of mishandling their finances, they manage their money well and keep a close eye on cash flow and other financial reports. Something every entrepreneur should learn to do. Business owners must know where their money comes from and where it ends up going. Yet, when I ask entrepreneurs for a quick breakdown on how much revenue is driven by which product or service, many either don't know or make incorrect assumptions. Some don't even know where their money is spent, including how much they take home from the business. Basically, they take what they can.

Struggling entrepreneurs often make the mistake of spending money in the wrong places. This is often due to poor decision-making that causes a ripple effect in the budget. This fact only reinforces the importance of the relationships mentioned above--an expert's experience and guidance will lead you down the right path and minimize costly mistakes.

What are the right spending choices?

Xero's report indicates that just under half (49 percent) of the entrepreneurs whose businesses hit the five-year mark spend on marketing campaigns and strategic initiatives, including advertising, social media, and PR. This compared to 20 percent of those whose businesses failed. 88 percent of the respondents who closed their doors say their failure to allocate funds to these areas greatly contributed to their company's demise.

In addition to a marketing budget, the business owners who shut their doors regret not taking initiative to improve their customer service. Just one in five invested in improvements to this area but all of them regret this decision and recommend that entrepreneurs do so.

The bottom line.

Your money management skills will make or break your business. Consult with your accountant regularly and ask those more experienced at running a business for help, because you simply don't know what you don't know. You are the only person who can make decisions for your business but it's wise to gather input from other experts before you do.

(This is an excerpt from https://www.hiscox.com/blog/business-bookkeeping-101-what-every-small-business-owner-needs-know, written by Kathleen Moore, and shared with appreciation.)

If you haven’t already, you should ensure that your business’s financial transactions are separate from your own. Partnerships, LLCs, and corporations are required by law to do this, but even if you are a sole proprietor, it’s a smart housekeeping step. You can start by opening a business checking and savings account. This is where your business’ income can be deposited, and bills paid, but it’s also where you can put aside a percentage of your income to pay your estimated tax bill. You can also apply for a business credit card or open a line of credit with routine vendors.

These moves can protect your personal finances from ruin if your business’s finances stumble. They will also begin building your business’s credit profile -- a financial gift that will keep giving as your business grows. And, finally, when it comes time to file your business taxes, you will have all of the numbers where you need them – in your business ledger, not your personal checkbook.

Are you committed to staying on top of your finances?

For most companies, bookkeeping isn’t the best part of running a business. In fact, it is often seen as a major downside – it takes a lot of time and effort which could be used to grow the business, or used as some extra free time. And you’re in business to run your business, not to spend long, frustrating hours trying to learn accounting principals and procedures, entering transactions, reconciling accounts and creating financial statements.

However, spending time on the bookkeeping and accounting aspects of your business certainly is important. Having your financial transactions and status laid out in front of you in a clear and easy-to-understand format can show you how well the business is doing, and give you some warnings when things aren’t going so well.

Don't let the details, the jargon, and the rules of small business bookkeeping overwhelm you. Contact Pearl Accounting Services and let us bring order to your books and joy to your heart.

Are you ready to document your expenses?

No matter who is keeping your books, it will be you paying the taxes at year's end. There are a lot of expenses that could reduce your burden - and the list of allowable deductions is always changing. Your bookkeeper can deliver the numbers at tax time, but it's up to you to retain records along the way. That means documenting the time, place, and purpose of every claimed expense - from business dinners to home office expenses. If you think an expense might qualify, document it and file the paperwork in an appropriate folder. You can easily retain receipts in a digital file by scanning or photographing them with your cellphone. A business credit card statement can also keep track of many deductible expenses.

Will you use a cash-based or accrual-based accounting system?

Bookkeepers use two accounting methods for tracking funds: cash-based or accrual-based. Here, again, the size of your business may be the determining factor for your choice.

(This is an excerpt from https://www.hiscox.com/blog/business-bookkeeping-101-what-every-small-business-owner-needs-know, written by Kathleen Moore, and shared with appreciation.)

Bookkeepers use two accounting methods for tracking funds: cash-based or accrual-based. Here, again, the size of your business may be the determining factor for your choice.

Many small businesses use cash accounting to record their transactions because it gives an accurate snapshot of their available cash without any delay. In essence, this method only records what is actually in your coffers, not what you are owed. So, if a customer leaves your business with $2,500 in goods today, that $2,500 will not show up as an accounts receivable credit of

$2,500. It will show up as cash when the customer pays his bill. And if you order $2,500 in supplies from a vendor, that money will not be debited until you write the check.

The opposite is true with an accrual method. The bill you issue that customer will immediately be recorded in the books as a credit to accounts receivable. And your inventory account (assets) will be debited by $2,500.

Not surprisingly, many larger businesses choose the accrual method to achieve a more complete picture of their financial and operational health.

Will you use single-entry or double-entry bookkeeping?

There are two-standard methods for recording your financial transactions. The one you use will depend on how detailed a picture you want to generate.

For many small or start-up businesses, the single-entry method is preferred, as it records all transactions in a single leger, much like a checkbook. Revenue and expenses are treated as deposits and withdrawals.

As its name suggests, double-entry bookkeeping involves two records for every transaction - a debit and a credit. It is the preferred method of professional bookkeepers and accountants, as it can accommodate a higher level of analysis. It allows you to track not only where money comes from but where it goes.

Every transaction consists of a debit and a credit in the same amount. It works like this: If your jelly and jam company purchases a new fruit-washing unit for $2500, it would show up first as a $2500 debit to your cash account. (Bookkeepers refer to outgoing funds as 'debits'). It would also show up as a $2500 credit to your equipment (assets) account. If you took out a loan to purchase the equipment, your liability account would get the debit of $2500, rather than your cash account.

(This is an excerpt from https://www.hiscox.com/blog/business-bookkeeping-101-what-every-small-business-owner-needs-know, written by Kathleen Moore, and shared with appreciation.)

There are two standard methods for recording your financial transactions. The one you use will depend on how detailed a picture you want to generate.

For many small or start-up businesses, the single-entry method is preferred, as it records all transactions in a single leger, much like a checkbook. Revenue and expenses are treated as deposits and withdrawals.

As its name suggests, double-entry bookkeeping involves two records for every transaction – a debit and a credit. It is the preferred method of professional bookkeepers and accountants, as it can accommodate a higher level of analysis. It allows you to track not only where money comes from but where it goes.

Every transaction consists of a debit and a credit in the same amount. It works like this: If your jelly and jam company purchases a new fruit-washing unit for $2500, it would show up first as a $2500 debit to your cash account. (Bookkeepers refer to outgoing funds as ‘debits’). It would also show up as a $2500 credit to your equipment (assets) account. If you took out a loan to purchase the equipment, your liability account would get the debit of $2500, rather than your cash account.

Do you know what books need to be kept?

You may be having someone else cnmch the numbers, but your own business savvy should extend to a rudimentary understanding of your books. Here's an overview of the things you should track:

(This is an excerpt from https://www.hiscox.com/blog/business-bookkeeping-101-what-every-small-business-owner-needs-know, written by Kathleen Moore, and shared with appreciation.)

You may be having someone else crunch the numbers, but your own business savvy should extend to a rudimentary understanding of your books. Here’s an overview of the things you should track:

Revenue - Any income derived by your business through its services or sales is considered revenue. This is the money that comes in the door. It has a lot of places to go.

Assets - These are the physical items or resources that are owned by your company. Their cash value should be assessed and documented, along with their proposed use, their date of purchase, their price, and any estimated depreciation. Typical assets include unsold inventory, equipment, office furniture, and office buildings.

Assets are not just physical, however. For a small or start-up business, it’s critical to keep tabs on accounts receivable – an asset that can quickly become a liability. Defined as “all the revenue a business has earned but has not yet collected,” these accounts represent the bills that others owe your business. Savvy business owners should always monitor vendors who generate large bills – pre-emptively offering credit repayment plans when circumstances merit – so that the promise of this asset delivers. Find out more about how accounts receivable work.

Liabilities - These are the items or resources that your business uses but does not entirely own. They are the loans, credit purchases, and bills (accounts payable) that in debt you to suppliers, banks, lenders, or other vendors. If your jelly and jam company purchases large amounts of Maine blueberries to produce your product, you may open a line of credit with that the blueberry farmer to keep pace with a sometimes outsized purchase. Find out more about how accounts payable work.

Expenses - Every cost your company incurs daily to provide services or produce goods is considered an expense, including rent, utilities, and employee compensation. Documentation of expenses can range from cash register tape receipts to bank account statements, credit card statements, invoices, and electronic funds transfer slips.

Equity - After all accounts have been assessed and updated, your equity account will tell you how much of your business remains in your ownership. Your assets are equal to your liabilities plus your equity, so it’s the business equivalent of your personal net worth.

Do you run a non-profit organization?

Pearl Bookkeeping and Accounting Services has over 20 years' experience managing nonprofit accounting. From entering transactions, to paying bills, reconciling accounts, running payroll, and reporting to the board and the government, Pearl can handle it all.

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more. Or maybe you have a creative project to share with the world. Whatever it is, the way you tell your story online can make all the difference.

Don’t worry about sounding professional. Sound like you. There are over 1.5 billion websites out there, but your story is what’s going to separate this one from the rest. If you read the words back and don’t hear your own voice in your head, that’s a good sign you still have more work to do.

Be clear, be confident and don’t overthink it. The beauty of your story is that it’s going to continue to evolve and your site can evolve with it. Your goal should be to make it feel right for right now. Later will take care of itself. It always does.

Have you recently started your own business?

You know what you're doing- whether it's interior design, landscaping, programming, product sale or service, that's yQUI area of expertise. That's why you started your own business. You understand your chosen profession and intend to succeed in that field.

Pearl Bookkeepfng and Accounting Services wants to help you succeed. Are you aware that many businesses go under in their first five years of existence, in part due to poor financial management? We'll help you concentrate on what you're good at. Most likely, you don't really specialize in accounting and bookkeeping. That is where Pearl Accounting can help.

We are experts in tracking and managing your finances. We understand the complexities of financial reporting and important triggers that a business needs to be aware of. We can handle your billing, payments, payroll and payroll tax reporting, reconciling bank and credit card accounts, and monthly, quarterly and annual financial statements.

Do you know that even as a sole proprietorship, you should open and maintain a separate bank account for your business? Opening a credit card account in the business name is a smart move as well. These steps accomplish several positive things for your business:

a more professional presentation to vendors and clients

helps build a business credit profile which can be critical through the lean times

allows easier tracking of your finances and seeing what's profitable and what isn't

makes tax reporting more straightforward as the transactions aren't mixed in with your personal finances

Pearl Accounting can help you create these accounts and track your data year-round. We can run daily, weekly, monthly, quarterly, and annual profit and loss statements and balance sheets, track your cash flow, track your receivables, payables, assets and liabilities, and manage payroll and payroll taxes.

Let Pearl Accounting and Bookkeeping Services help you succeed in your business. We'll give you personal, one-on-one attention and work with you to ensure you receive exactly what you and your business need. Call, text or email today for a free consultation.

You know what you're doing- whether it's interior design, landscaping, programming, product sale or service, that's yQUI area of expertise. That's why you started your own business. You understand your chosen profession and intend to succeed in that field.

Pearl Accounting Services wants to help you succeed. Are you aware that many businesses go under in their first five years of existence, in part due to poor financial management? We'll help you concentrate on what you're good at. Most likely, you don't really specialize in accounting and bookkeeping. That is where Pearl Accounting can help.

We are experts in tracking and managing your finances. We understand the complexities of financial reporting and important triggers that a business needs to be aware of. We can handle your billing, payments, payroll and payroll tax reporting, reconciling bank and credit card accounts, and monthly, quarterly and annual financial statements.

Do you know that even as a sole proprietorship, you should open and maintain a separate bank account for your business? Opening a credit card account in the business name is a smart move as well. These steps accomplish several positive things for your business:

a more professional presentation to vendors and clients

helps build a business credit profile which can be critical through the lean times

allows easier tracking of your finances and seeing what's profitable and what isn't

makes tax reporting more straightforward as the transactions aren't mixed in with your personal finances

Pearl Accounting can help you create these accounts and track your data year-round. We can run daily, weekly, monthly, quarterly, and annual profit and loss statements and balance sheets, track your cash flow, track your receivables, payables, assets and liabilities, and manage payroll and payroll taxes.

Let Pearl Accounting and Bookkeeping Services help you succeed in your business. We'll give you personal, one-on-one attention and work with you to ensure you receive exactly what you and your business need. Call, text or email today for a free consultation.

Are your personal and business finances separate?

If you haven't already, you should ensure that your business's financial transactions are separate from your own. Partnerships, LLCs and corporations are required by law to do this, but even if you are a sole proprietor, it's a smart housekeeping step. You can start by opening a business checking and savings account. This is where your business's income can be deposited, and bills paid, but it's aJso where you can put aside a percentage of your income to pay your estimated tax bill. You can also apply for a business credit card or open a line of credit with routine vendors.

These moves can protect your personal finances from ruin if your business's finances stumble. They will also begin building your business's credit profile -- a financial gift that will keep giving as your business grows. And, finally, when it comes time to file your business taxes, you will have all of the numbers where you need them -in your business ledger, not your personal checkbook.

(This is an excerpt from https://www.hiscox.com/blog/business-bookkeeping-101-what-every-small-business-owner-needs-know, written by Kathleen Moore, and shared with appreciation.)

If you haven’t already, you should ensure that your business’s financial transactions are separate from your own. Partnerships, LLCs, and corporations are required by law to do this, but even if you are a sole proprietor, it’s a smart housekeeping step. You can start by opening a business checking and savings account. This is where your business’ income can be deposited, and bills paid, but it’s also where you can put aside a percentage of your income to pay your estimated tax bill. You can also apply for a business credit card or open a line of credit with routine vendors.

These moves can protect your personal finances from ruin if your business’s finances stumble. They will also begin building your business’s credit profile -- a financial gift that will keep giving as your business grows. And, finally, when it comes time to file your business taxes, you will have all of the numbers where you need them – in your business ledger, not your personal checkbook.